The Takeaways

- Mortgage payments remain the responsibility of the homeowner, even after a severe fire damages or destroys a property.

- Most mortgage agreements require you to notify the mortgage company of a severe loss and to keep making payments regardless of the condition of the home.

- Failing to pay your mortgage could lead to foreclosure, even if the home is uninhabitable.

- Insurance proceeds, including those from your homeowner's policy, will only help cover repairs, they don’t cover mortgage payments directly.

- A Public Adjuster can help ensure you receive a fair settlement to ease the financial strain during the recovery process.

Over the years at True View Commercial, we’ve encountered the question, “If my home is unlivable due to a fire, do I still need to pay my mortgage?”

The short answer is, “Yes.”

Even in the aftermath of a severe residential fire, your mortgage agreement remains legally binding, requiring you to continue making monthly payments. In addition, the mortgage company agreement requires that borrowers promptly notify the mortgage company of a severe loss.

This can feel overwhelming, especially if your property is heavily damaged or destroyed. However, understanding your obligations and rights can help you navigate this challenging time. Leaning on the expertise of a Public Adjuster can help speed the recovery process, maximize your financial settlement, and ease stress.

What Does Your Mortgage Agreement Require?

When you sign a mortgage, you enter into a binding contract with your lender. This agreement ensures that you repay the loan in regular installments over time, regardless of the property’s condition. A fire or other catastrophic event does not cancel or suspend your obligation to make payments.

Failing to make timely payments could result in penalties, late fees, or even foreclosure, depending on the lender’s policies. In some cases, lenders may work with you to modify payment schedules temporarily, but this is not guaranteed.

Over the years, we have handled claims where insureds, against our advice, did not make their mortgage payments. The mortgage companies sent warning letters advising the insureds to make their mortgage payments or face foreclosure. In most cases, the mortgage companies were understandable and were willing to work with the insured to an extent. However, we have also seen homes being foreclosed on in the Dallas/Fort Worth area due to non-payment.

Can Insurance Help Cover Mortgage Payments?

No. Your homeowner's insurance policy is designed to protect your property (you) financially after a covered loss, such as a fire. However, it’s essential to understand what insurance can, and cannot, do in this situation:

- Insurance Dwelling Proceeds: Most policies provide funds to repair or rebuild your home. These payments are often made jointly to you and your mortgage company, as the lender is the primary lien holder and has a vested interest in restoring the property.

- Insurance Additional Living Expenses (ALE): If you have loss-of-use coverage, your policy may reimburse you for temporary housing costs while repairs are underway. However, ALE does not cover mortgage payments, rather, it covers the costs incurred to maintain the same standard of living in a home of like kind and quality.

- Insurance Loss of Rental Income: If the property is used as a rental, many policies include coverage for lost rental income during the time the property is being repaired. This can help offset the financial burden of making mortgage payments while the property is uninhabitable. Be sure to confirm this coverage in your policy and consult with a Public Adjuster to ensure you receive the full benefit.

What Are Your Options?

If you’re unable to pay your mortgage due to financial strain following a fire, there are several potential avenues to explore:

- Contact Your Lender: Some mortgage companies offer temporary forbearance programs or other relief options for homeowners facing financial hardship. Be sure to explain your situation and provide documentation of the fire and its impact on your finances.

- Hire a Public Adjuster: A licensed Public Adjuster can help maximize your insurance claim settlement, ensuring you receive the funds you’re entitled to for repairs and recovery. This can reduce the financial pressure of dealing with both a mortgage and the costs of rebuilding.

- Explore Legal Advice: In cases where financial obligations become too complex, consulting with an attorney or financial advisor can provide clarity and help you make informed decisions.

Why a Public Adjuster Can Help

Navigating the aftermath of a fire, particularly when balancing insurance claims and mortgage obligations, can be incredibly stressful and time-consuming. This is where a Public Adjuster’s expertise becomes invaluable.

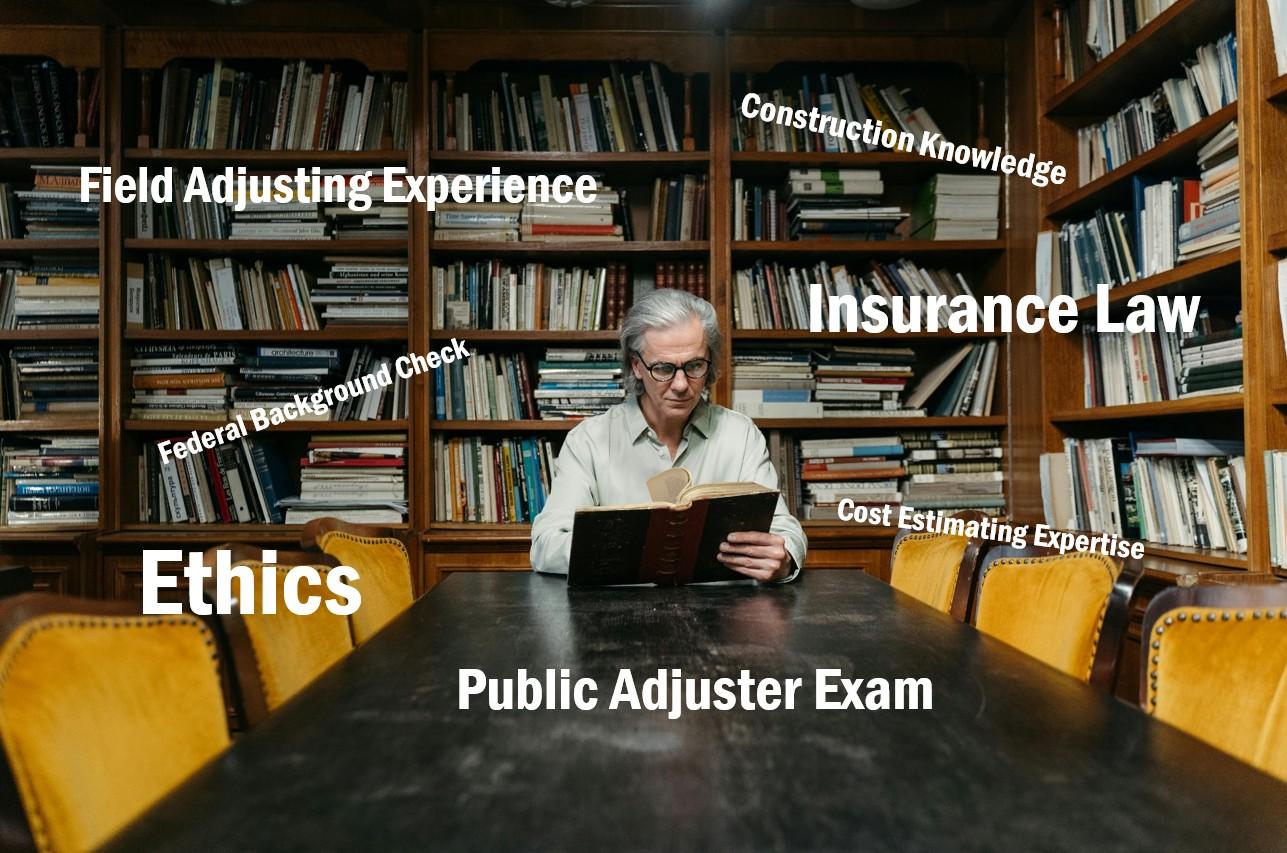

Expertise

Public Adjusters specialize in handling insurance claims and have extensive experience with fire-related losses and other large-scale damages. They are equipped to thoroughly assess the full scope of the loss, including hidden damages that may not be immediately visible, ensuring nothing is overlooked when filing your claim.

Advocacy

One of the most significant advantages of working with a Public Adjuster is their ability to negotiate directly with your insurance company. They understand the intricacies of insurance policies and know how to fight for a fair settlement, ensuring you have the funds necessary to repair your home and recover financially. By streamlining the claims process and avoiding common pitfalls that can cause delays, a Public Adjuster can help speed up the entire recovery process.

Claim Management

Beyond handling the claim itself, the Public Adjusters at True View Commercial offer complete claim management. They coordinate inspections, prepare detailed documentation, and communicate directly with the insurer on your behalf. This takes the burden off your shoulders, giving you the time and mental space to focus on your personal life, family, and work. Instead of being consumed by the complexities of the claims process, you can prioritize getting your life back to normal as quickly as possible.

Advisor Capacity

Public Adjusters also serve as trusted advisors during a challenging time. Their routine handling of similar claims provides them with the expertise to guide you through the insurance process, helping you make informed decisions and avoid costly mistakes. Most importantly, they offer peace of mind. Knowing that a professional is advocating for you allows you to focus on what matters most; rebuilding your home, restoring your financial stability, and returning to your daily life.

By choosing to work with a Public Adjuster, you gain an experienced partner who ensures your claim is handled efficiently and thoroughly, maximizing your settlement while freeing you to focus on your recovery.

When in Doubt, Ask for Help

The aftermath of a severe fire is one of the most stressful experiences a homeowner can face. While the legal and financial obligations tied to your mortgage may feel burdensome, there are resources and professionals available to help you navigate the process.

If you have questions about your insurance claim, mortgage obligations, or anything else related to your loss, contact True View Commercial. One of our licensed experts can guide you through the steps to recovery.

Note: True View Commercial does not practice law or provide legal advice. For specific legal concerns, please contact a qualified attorney.