The Takeaways

- Understand Your Policy: Familiarize yourself with the details of your insurance policy to know your coverage and rights.

- Document Everything: Keep thorough records of all communications, damages, and expenses related to your claim.

- Communicate Clearly: Be concise and clear in all interactions with the insurance adjuster to avoid misunderstandings.

- Stay Professional: Maintain a calm and professional demeanor, even if negotiations become challenging.

- Seek Expert Help: Consider hiring a public adjuster or legal advisor if you encounter difficulties or need additional support in handling your claim.

Navigating Insurance Claims: Essential Tips For Dealing With Insurance Adjusters

As a property owner, understanding the intricacies of insurance claims is vital, especially when you’re faced with unexpected disasters like a house fire or water damage. Knowing how to deal effectively with insurance adjusters and understanding the reasons behind potential claim rejections can make a significant difference in the outcome of your claim. This guide provides essential tips and insights to help you navigate the complex landscape of property insurance claims.

Tips for Dealing with an Insurance Adjuster

Dealing with an insurance adjuster can be daunting, but a strategic approach can lead to a more favorable settlement. True View Commercial has compiled some helpful tips and explanations that can help you become more informed about your claim and make better decisions during the various claim steps.

Document Everything

Take Detailed Notes and Photos: Immediately after the damage occurs, document everything thoroughly. Take clear photos and videos of all affected areas and items from multiple angles. Note the date and time each photo was taken.

Example: If a pipe bursts and floods your kitchen, take photos of the burst pipe, the water damage to floors and walls, and any damaged personal belongings.

Keep Receipts: Maintain receipts for all expenses related to the damage, such as emergency repairs, temporary accommodations, and replacement items.

Example: If you need to stay at a hotel while your home is being repaired, keep the hotel bills and any dining receipts.

Create a Written Record: Keep a journal of all actions taken and conversations held regarding the incident. Note down dates, times, and key points discussed.

Be Honest and Accurate

Provide Truthful Information: Always give honest and precise details about the incident and the extent of the damage. Exaggerating or falsifying information can lead to claim denial or legal repercussions.

Example: If a fire damages your kitchen, accurately report the extent of the damage without inflating the value of lost items.

Consistency is Key: Ensure that your descriptions are consistent across all forms of communication—whether written, verbal, or photographic.

Understand Your Policy

Review Coverage Details: Familiarize yourself with your insurance policy, paying close attention to coverage limits, deductibles, and exclusions. These can all be found on the Declarations page (Dec Page) of your policy. Understanding these details helps you set realistic expectations and prepares you for any potential out-of-pocket expenses.

Example: Examine your dec page to review the dollar figure limits for coverage like Dwelling, Loss of Use, and Contents. Also, look for endorsements to your policy such as Mold or Increase Cost of Construction.

Ask Questions: If any part of your policy is unclear, contact your insurance agent for clarification. It’s crucial to know what is covered and what isn’t before you file a claim.

Stay Organized

Maintain a Dedicated File: Keep all documentation related to your claim in one place. This includes all written communications, photos, receipts, and your insurance policy.

Example: Use a physical folder or digital file system to store emails, claim forms, and notes from phone calls.

Track Communications: Record all interactions with your insurance company, including the names of representatives you spoke with, dates of conversations, and what was discussed.

Example: If you discuss your claim with an adjuster over the phone, note the date and a summary of the conversation immediately after hanging up. If an adjuster promises a policy benefit or states that something is covered, note the statement in writing.

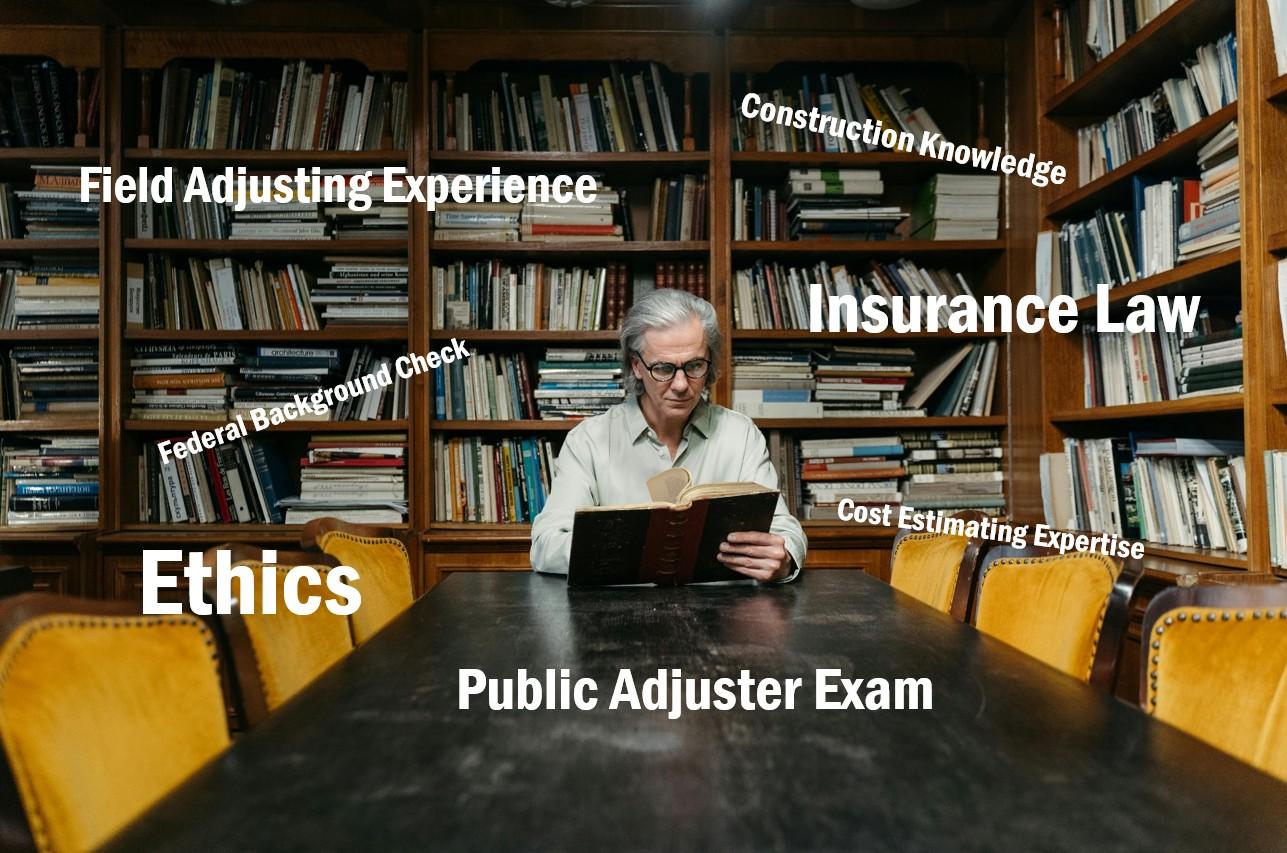

Hire a Public Adjuster

Professional Advocacy: Public adjusters, such as those at True View Commercial, work on your behalf—not the insurance company’s. They can handle the complexities of your claim, negotiate settlements, and ensure you receive the maximum compensation.

Example: If your home suffers extensive damage from a house fire, a public adjuster can assess the damage, document it comprehensively, and negotiate with your insurance company to secure a fair settlement.

Stress Reduction: Public adjusters can reduce the stress and workload associated with filing a claim, allowing you to focus on recovering and rebuilding.

Expertise and Experience: With their deep knowledge of insurance policies and claim processes, public adjusters can identify coverage areas you might overlook and ensure all damages are accounted for in your claim.

By following these tips, you can streamline the claims process, reduce stress, and improve the likelihood of a favorable outcome. Hiring a public adjuster further enhances your ability to navigate the complexities of insurance claims efficiently and effectively, ultimately resulting in a higher claim settlement and faster recovery.