The Takeaways

- Tornados produce damaging winds that can reach over 300 mph causing more than $1B in damage in the US alone.

- Insurance companies’ adjusters are required to handle a high volume of claims which leads to less time and attention spent on each claim.

- A second inspection from a Public Adjuster can correctly identify costly items that may have been missed initially.

- A Public Adjuster can provide a more thorough claim investigation and analysis of your specific recovery goals.

The aftermath of a tornadic event can be shocking. A walk through the affected area will certainly leave you saying “… We’re not in Kansas anymore.” Downed trees and telephone poles, electric power lines are strewn across the streets, building material debris everywhere, and what trees remain standing have been stripped of their limbs and leaves. This was the scene of the residents who endured the October 20, 2019 tornado in Dallas, Texas.

What about the homes and businesses left standing in the area? Damage caused to a structure from high winds, specifically, a tornado, will wreak havoc on nearly every building component of a structure. You may think your insurance adjuster is an expert on tornado damage to your property, but I wouldn’t be so hopeful.

Tornado Forces

Tornados are vortex powerhouses and are estimated to cause over $1B in property damage annually in the United States. Tornado intensity is measured by 5 levels on the Fujita Scale, F0 through F5. F0 tornados produce winds of 40 to 72 mph whilst F5 events can produce winds over 300 mph. Within that range, most tornados that occur fall into the category of F2 with wind speeds of 113-157 mph.

Tornados not only produce straight-line winds but also produce immense downward pressure as well as wind uplift. These forces occur almost simultaneously on a structure which results in the sense that the whole structure is vibrating. Furthermore, clients I speak with always mention that the pressure was so great, that their ears popped multiple times while the family was hiding in the closet under the stairs.

Catastrophe Adjusters

When a large-scale disaster occurs, insurance companies will typically deploy their Catastrophe (Cat) Adjusters. This is a group of adjusters within the insurance company who primarily travel around the US and survey damage ranging from tornados to hurricanes or forest fires to large explosions. These adjusters typically have a decent level of experience seeing a wide variety of severe claims. However, this in no way makes them an expert or correlates to an appropriate claim settlement.

When a Cat Adjuster is sent to assess your damage, your business or home is not the only one that he/she will be seeing that day. Cat Adjusters are given a long list of properties to survey daily – and this can go on for weeks at a time for that adjuster. So, while he/she may have experience in seeing a high volume of damage, this does not mean the damage is being correctly identified due to hidden structural damage or lack of adequate training. Often times a Cat Adjuster is working alone on file. When I find that damage was missed by the Cat Adjuster, I explain to the client that my finding more damage is simply the value of the second set of eyes on a claim and not necessarily any mal intentions from the previous adjuster. That’s politically correct, right?

The Added Value of a Second Opinion

As a Public Adjuster, I frequently review commercial and residential claims after the initial insurance company does its thing. For commercial claims, my second opinion can be the difference between the insurance company offering $50k in repairs and my company achieving a $300,000 full roof replacement. In residential disasters, additional damage is typically discovered in the structure in the form of broken attic rafters and other roofing components, broken brick ties, or broken window seals to name a few. Should someone decide to sell their home in the future, these missed items would surely be discovered by the home inspector during the buyer’s due diligence phase – at that point, it’s too late.

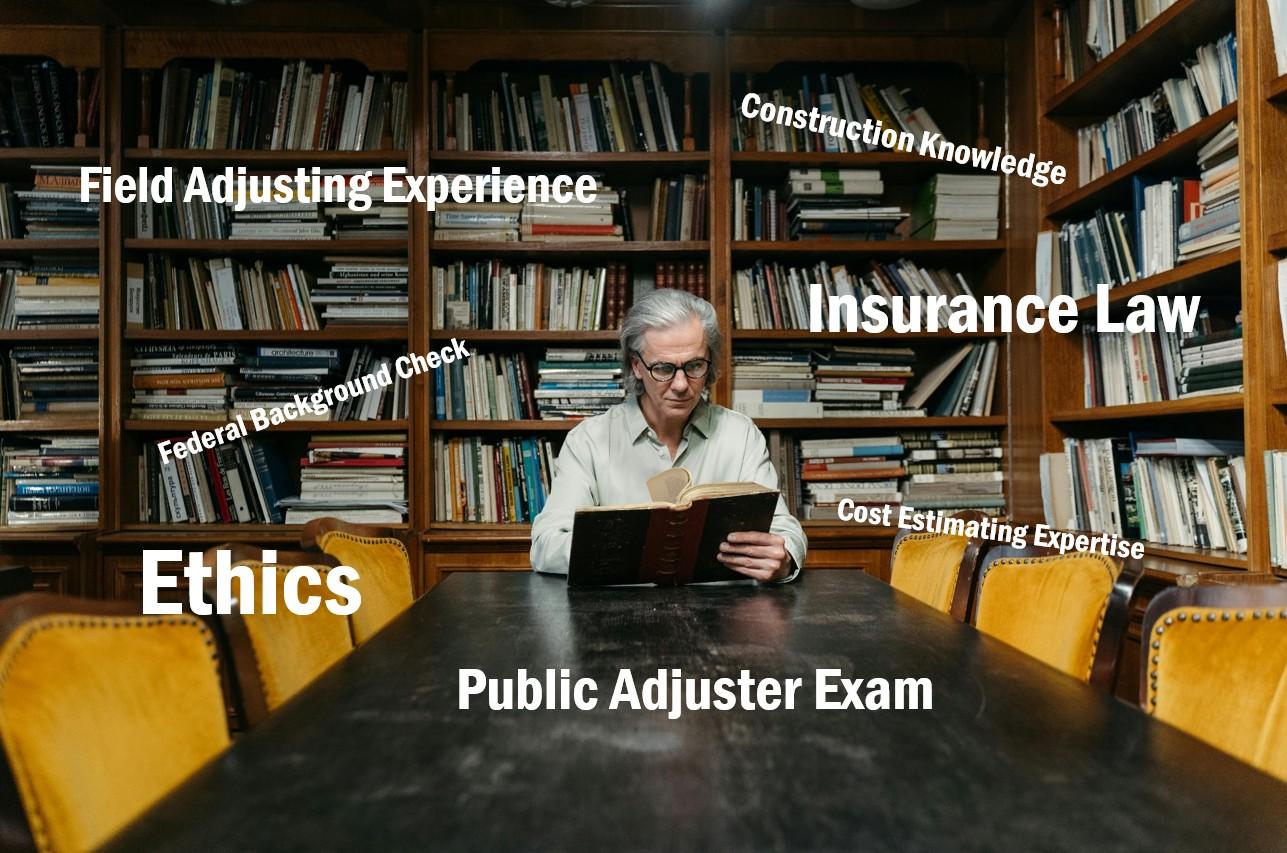

When faced with a disaster, always get a second opinion from a Public Insurance Adjuster. In most cases, A Public Adjuster is not handling the heavy claim volume like the Cat Adjusters. This means that the Public Adjuster can spend more time investigating your claim, analyzing your goals, and developing an optimized recovery plan that suits your needs. A well-established Public Adjuster also knows the right experts who can provide yet another set of eyes – these folks can range from licensed structural engineers to licensed mold remediation experts to qualified reconstruction companies with real-world experience in actually reviving a structure after a severe loss.