The Takeaways

- Your insurance company adjuster works only for your insurance company.

- A Public Adjuster is an insurance adjuster that is licensed by the State Department of Insurance and works directly for YOU, not your insurance company.

- Public Adjusters are experts at handling large and/or complex insurance claims.

- A Public Adjuster, for a fee, will handle the entire claim process on your behalf with a focus on maximizing your insurance settlement for you.

What Is A Public Adjuster And What Do They Do?

When you file a property insurance claim, your insurance company will assign you a claims adjuster, sometimes referred to as a Company Adjuster, to handle your claim on the insurance company’s behalf. Company Adjusters are employees of insurance companies and they are expected to serve the needs of the insurance company. In addition, they are encouraged to settle claims as quickly as possible and reduce insurance settlement payouts. Generally, these professionals want to fairly settle your claim based on your policy coverage and the severity of your loss.

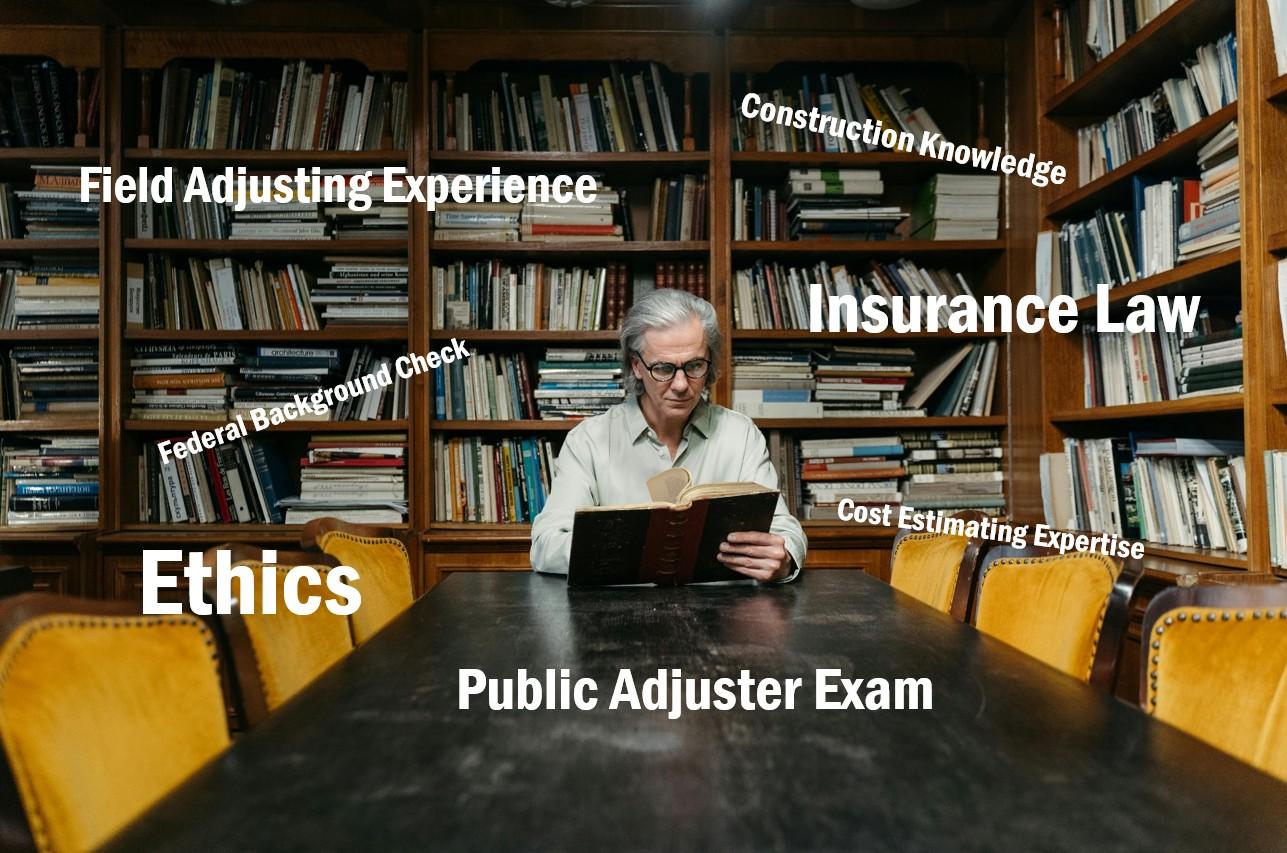

When you have an insurance loss, you do have another avenue for seeking a fair resolution to your claim. You can hire a Public Insurance Adjuster (Public Adjuster or PA) to represent you on all matters pertaining to your claim. A Public Adjuster is an insurance adjuster that is licensed by the State Department of Insurance and works directly for YOU, not your insurance company. Just as your insurance company employs Company Adjusters that serve their best interest, you are permitted to hire a Public Adjuster to act as your advocate and to negotiate the settlement of your insurance claim. This ensures that you receive every insurance policy benefit available to you when dealing with an insurance loss.

Unfortunately, claim settlements are at times lower than expected, and insureds may feel entitled to additional money. Some reasons insureds may feel something is missing could be a disagreement over policy coverage, disputes over what actually constitutes damage, questions surrounding what damage is related to the loss, or something as simple as damage that was overlooked by the Company Adjuster. The solution to getting a fair and accurate property insurance claim settlement may be to hire a Public Insurance Adjuster.

Homeowners can elect to hire a Public Adjuster to represent them in the claims process and act on their behalf in the dispute with their insurance company. Public Adjusters are independent professionals licensed by their state’s Department of Insurance to work directly for policyholders. A Public Adjuster will examine the damage to your property, determine an accurate scope of repairs, and set the replacement cost value for all damaged materials.

Public Adjusters are paid fees based on you the settlement of your claim and those fees are set by your State Department of Insurance. Although your Public Adjuster will charge you a percentage of the total amount adjusted, the fees are greatly outweighed by the additional amount of funds you receive from your insurance carrier.

When Should You Hire A Public Adjuster?

Many circumstances throughout a property insurance claim lend themselves to hiring a Public Insurance Adjuster. As with most situations surrounding large or complex claims, timing is everything. It is always best to engage a Public Adjuster at the onset of the loss. When you hire a Public Adjuster, it can be seen as a turnkey claim solution. From the beginning of a claim, a Public Adjuster will reduce stress, save a policyholder’s time, and will result in higher claim settlement figures.

For exceptionally large claims where there is potential for damage to be overlooked, Public Adjusters are a great solution for ensuring that all damage is correctly identified and documented. With any undertaking of significant magnitude, most people search for a second opinion. A large loss insurance claim should be no exception. For more info on why an insurance claim is a perfect example for seeking a second opinion, click HERE to read all about it!

Lastly, some property owners simply choose to hire a public claims adjuster because they have had previous bad experiences with their insurance claims. As Public Adjusters, we are often the outlet for policyholders to vent to. Common complaints we are from bad experiences are things like poor communication, extended settlement time frames, Company Adjusters with little experience, Company Adjusters being “too busy” to give a claim proper attention, poor claim settlement values, or insureds claiming that they “had to fight for everything”.

A Public Adjuster works for you, not the insurance company. There is no conflict of interest and settling your claim with best practices is the main priority… which typically results in a faster claim resolution and a higher payout.

What Should You Expect From Hiring A Public Adjuster?

Before agreeing to settle your property claim, you have the opportunity to negotiate with the insurance company. If you choose to do this, your Public Adjuster will function as the liaison, releasing you of the duty to personally communicate and negotiate confusing claim processes directly with your insurance company.

When you hire a Public Adjuster, he/she will handle the entire claim process on your behalf. He will visit your property to survey the damage, do a comprehensive review of your insurance policy, develop a detailed plan of recovery based on your specific needs and goals, create an accurate scope of repairs, calculate the recommended settlement value, and coordinate/communicate directly with your insurance company to process your settlement.

Public Adjusters are paid fees based on you the settlement of your claim and those fees are set by your State Department of Insurance. Although your Public Adjuster will charge you a percentage of the total amount adjusted, the fees are greatly outweighed by the additional amount of funds you receive from your insurance carrier.

Can I Hire A Contractor To Settle My Claim Instead Of A Public Adjuster?

The short answer is, No.

A contractor and a Public Adjuster have separate responsibilities that are clearly defined by law and detailed by your state’s Department of Insurance. Although a contractor may be qualified to survey property damage and estimate repair costs, BY LAW they cannot manage insurance claims, negotiate with a Company Adjuster, or speak on your behalf. If a Public Adjuster finds a claim to require specific restoration needs pertaining to custom cost estimating, he/she can decide to consult with a contractor for a second opinion. In the State of Texas, if a contractor is not a licensed Public Adjuster, he/she cannot:

- Investigate, appraise, evaluate, or advocate for the claimant in adjusting a claim

- Prepare the insurance claim for a claimant

- Negotiate the claim with the insurer on the claimant’s behalf

- Review and/or advise the claimant about the terms of their policy coverage

- Advertise that they can serve as a claim adjuster

For specific Texas Department of Insurance Regulation, click here.

Is a Public Adjuster Right For You?

At True View Commercial, our Public Adjusters are experts in the identification of damage, leveraging superior technology to provide an accurate scope of damage and material identification, providing large loss insurance claim management, and promptly and accurately negotiating and settling claims. With a proven history of substantially increasing insurance claim settlements for our clients, we strive to make policyholders whole again while reducing stress and insurance claim cycle time.

To best understand where you are in your insurance claim process and learn if True View Commercial can provide expert Public Adjusting services to maximize the financial settlement of your insurance claim, please contact our office today!